Efectos ley de borrón y cuenta nueva cartera consumo

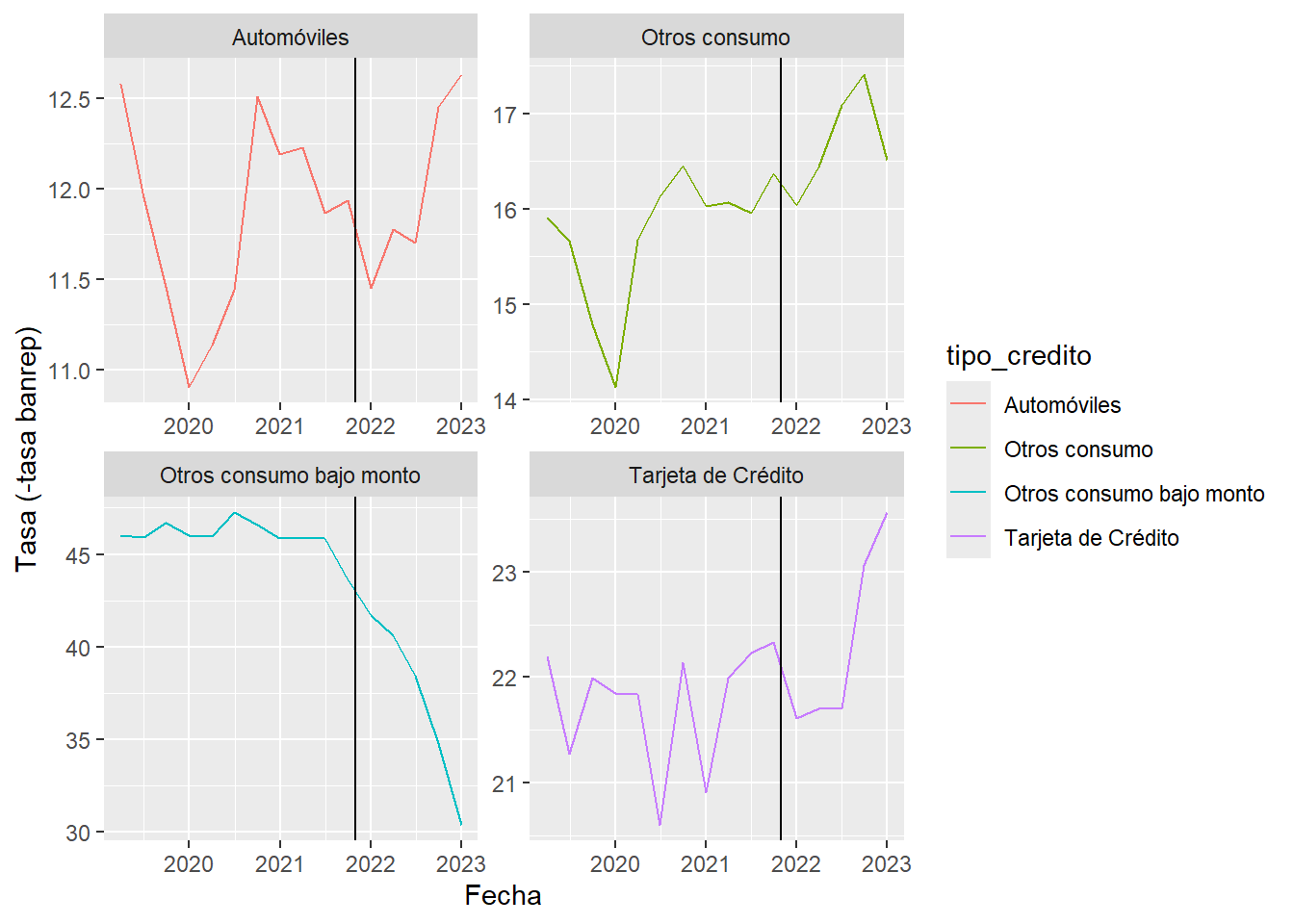

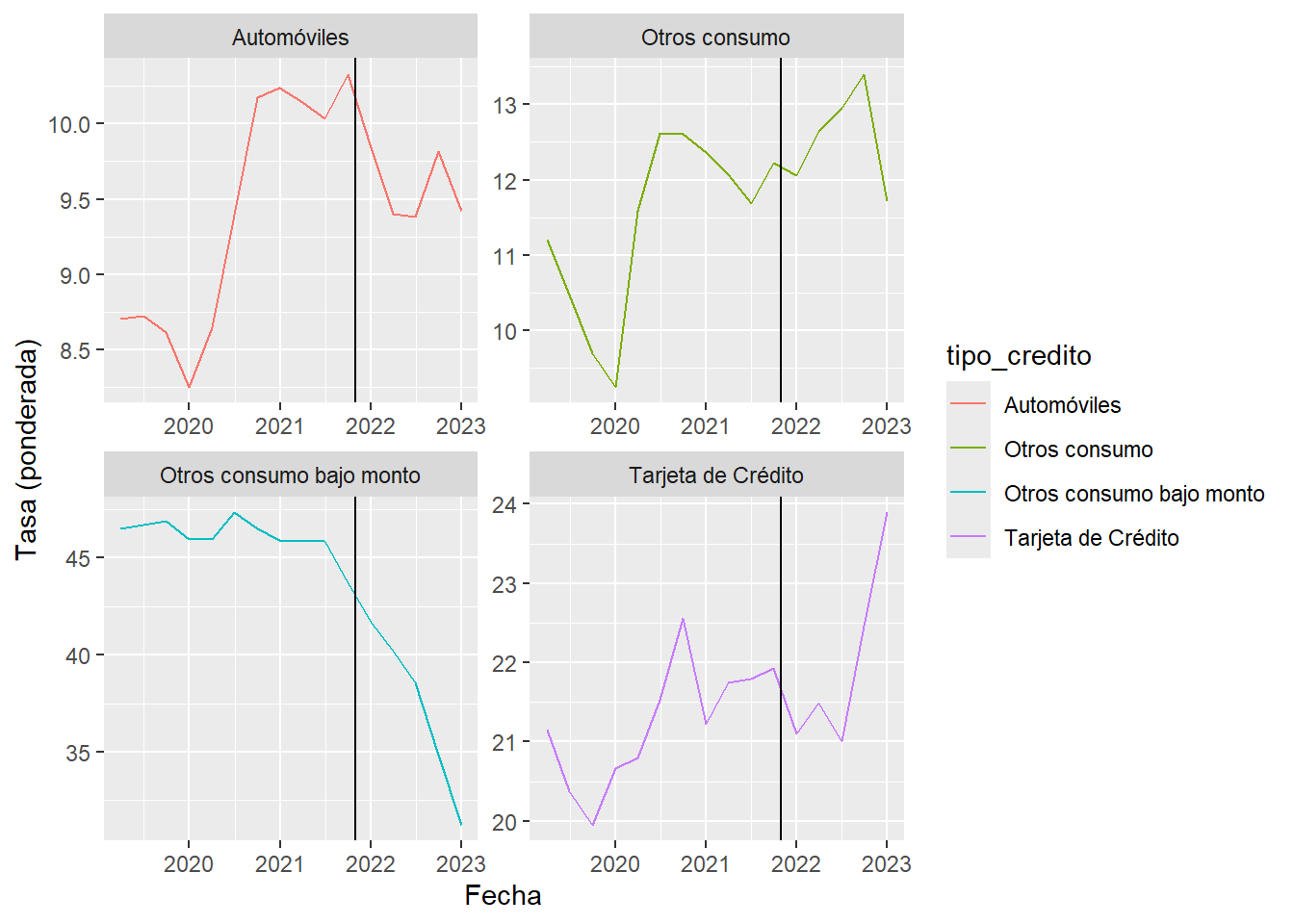

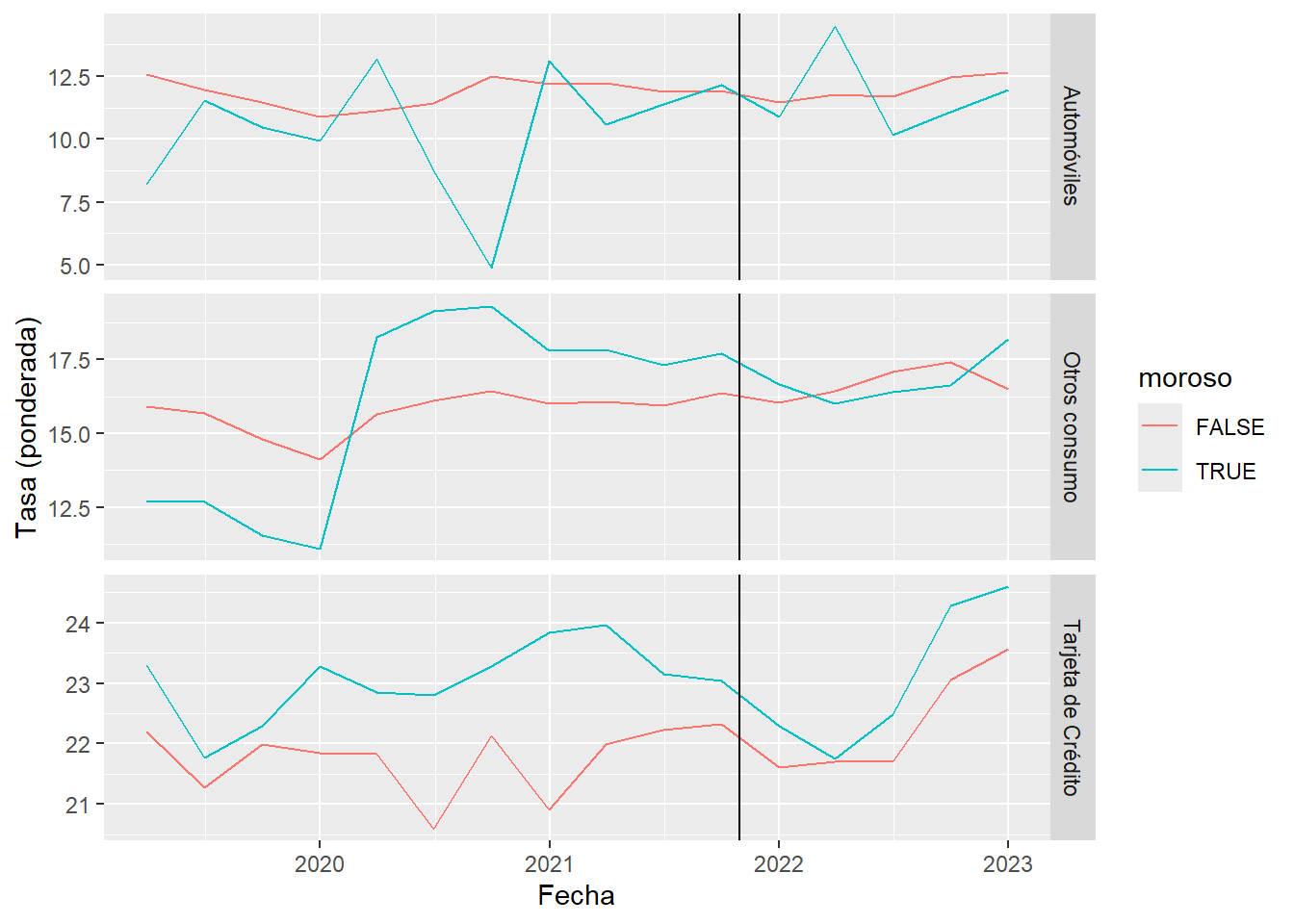

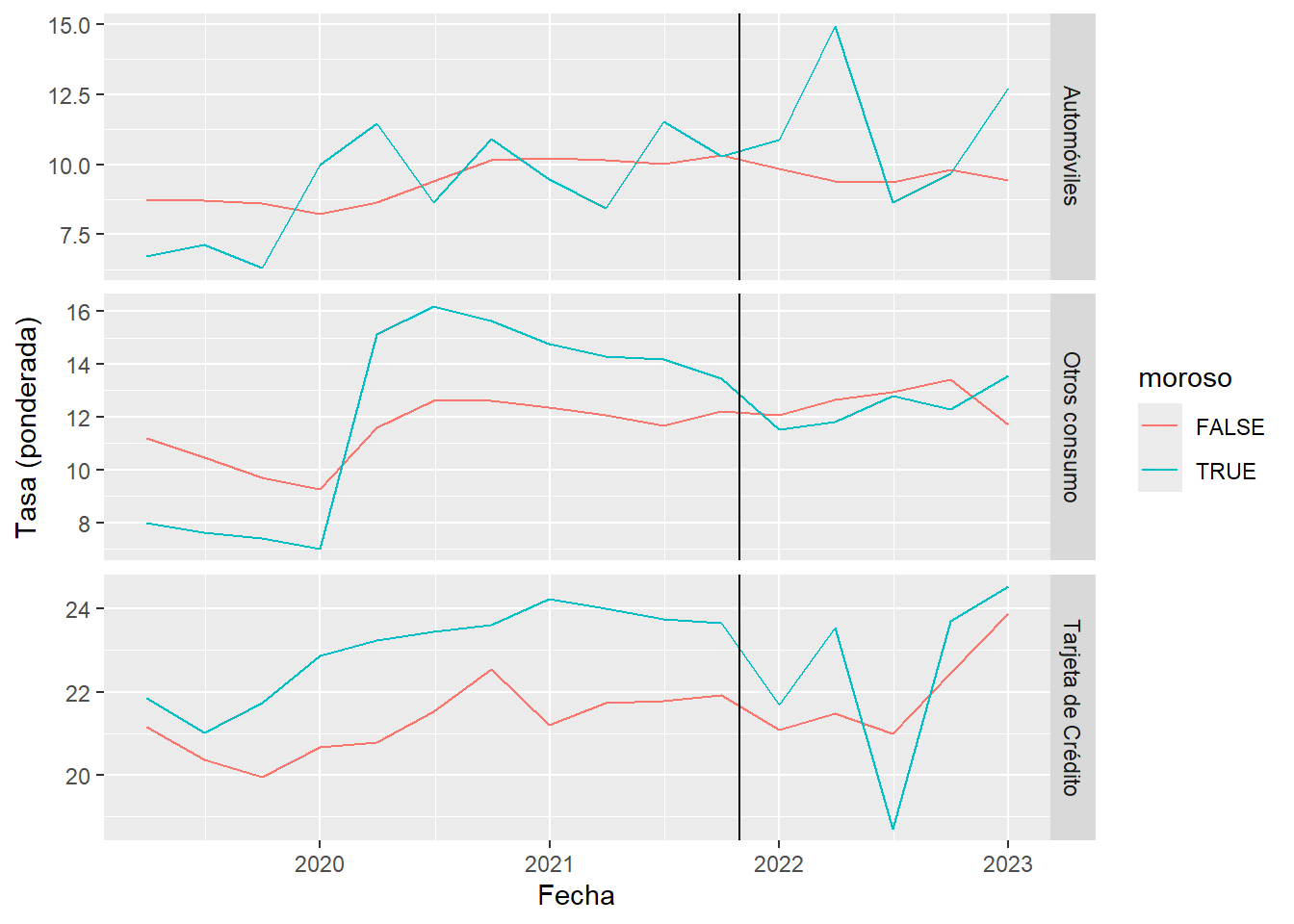

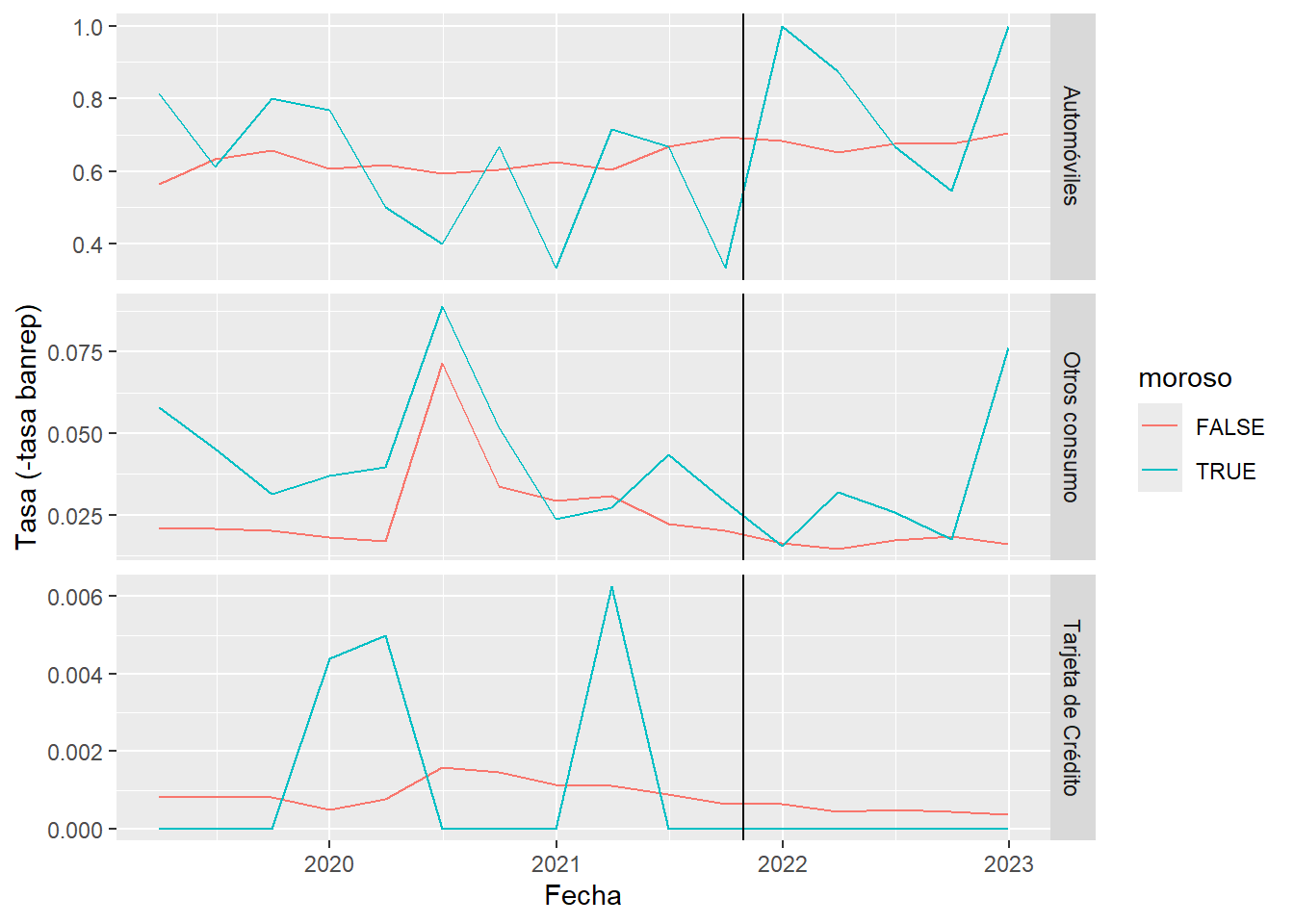

1 Tasas de interés antes y después

1.1 Tasa promedio simple

1.2 Tasa promedio ponderada por monto

1.3 Tasa promedio simple por moroso

1.4 Tasa promedio ponderada por monto por moroso

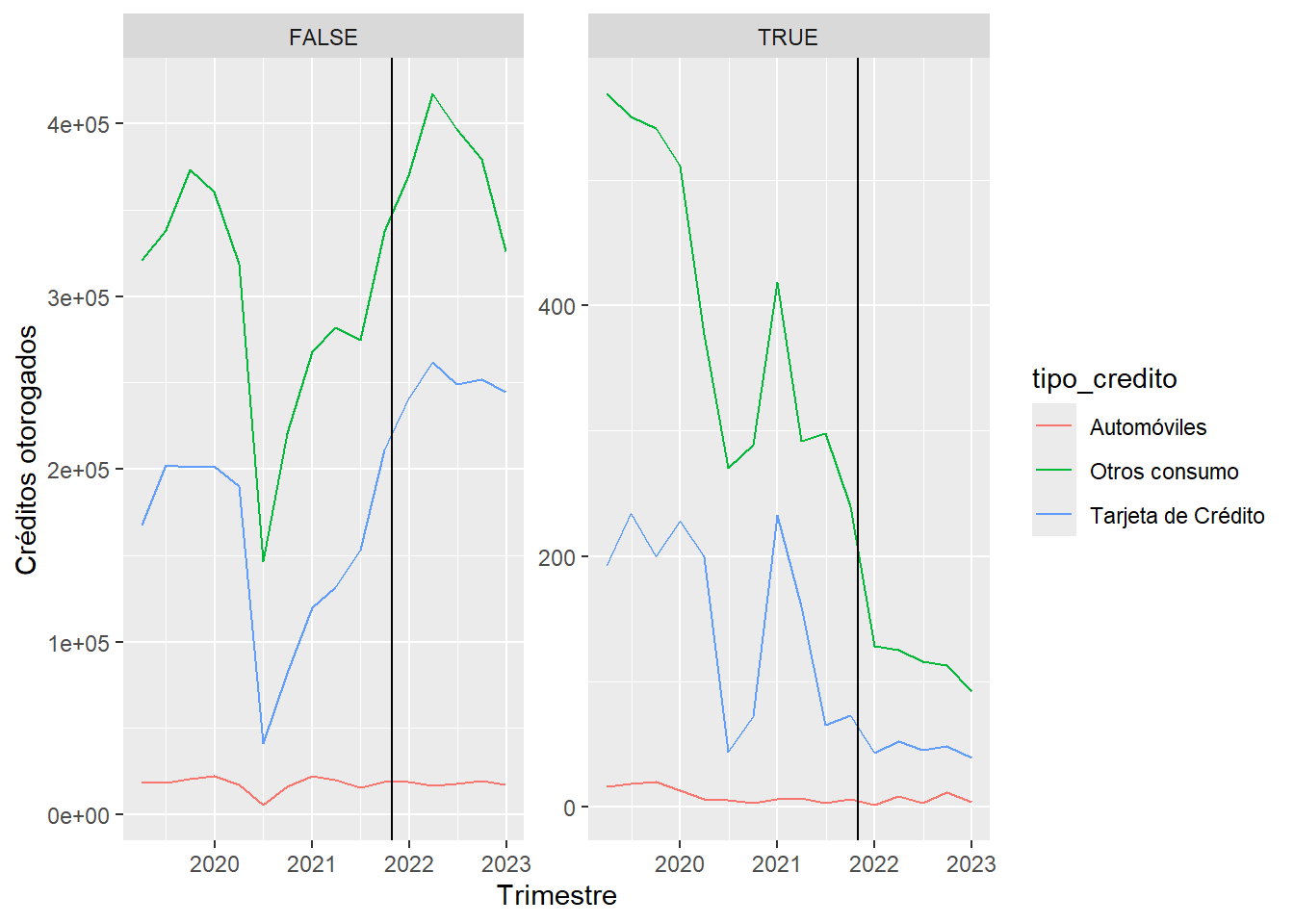

2 Numero de créditos nuevos antes y después

2.1 Créditos nuevos

2.2 Créditos nuevos por moroso

3 Créditos con colateral

4 Créditos con colateral por moroso

5 tasas, monto y plazo

6 Ratas limpias y sucias

Muestra:

- Sólo créditos de tipo “Otros consumo”.

- Nos quedamos con gente que tiene créditos activos en marzo de 2021 (antes de la ley de borrón) y sin mora.

- Miramos sus historias crediticias y marcamos a aquellos que tuvieron mora(90 días o más) hasta diciembre de 2020.

- En una grilla de trimestres e identificaciones marcamos donde obtuvieron un crédito nuevo (variable dependiente)

- Definimos after a los trimestres después de octubre 2021.

Regresión

\[Prob(nuevo_{it})= \beta_0 + \beta_1 after_t + \beta_2 moraprevia_{i}, \beta_3 after_t \times moraprevia_{i} + \epsilon_{it}\]

Call:

lm(formula = new ~ after * morat, data = dt_reg)

Residuals:

Min 1Q Median 3Q Max

-0.2286 -0.2044 -0.1593 -0.1593 0.8429

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.2044113 0.0008706 234.792 <2e-16 ***

afterTRUE -0.0451542 0.0011239 -40.175 <2e-16 ***

moratTRUE -0.0472685 0.0455830 -1.037 0.2997

afterTRUE:moratTRUE 0.1165828 0.0588474 1.981 0.0476 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.3813 on 479731 degrees of freedom

Multiple R-squared: 0.003357, Adjusted R-squared: 0.003351

F-statistic: 538.7 on 3 and 479731 DF, p-value: < 2.2e-167 Ratas limpias y sucias todos los activos diciembre (no solo los nuevos)

8 Probabilidad de créditos nuevos DESPUÉS de la ley

Cambié el enfoque porque como estabamos definiendo la variable dependeitne estaba imputando muchos ceros (la gente que saca un crédito en t probablemente no va a sacar en t+1 o t+2).

La muestra: gente activa en el mercado de crédito y sin mora en diciembre 2020.

Se marca a los que tuvierno mora antes de diciembre 2020 hasta 2015 (morat=1)

La variable dependiente es si la persona obtuvo un crédito post ley (entre diciembre y junio de 2022)

==================================================================

Model 1 Model 2 Model 3

------------------------------------------------------------------

(Intercept) 0.186 *** 0.126 *** 0.049 ***

(0.001) (0.001) (0.000)

moratTRUE 0.060 *** 0.062 *** 0.047 ***

(0.001) (0.001) (0.000)

after 0.018 ***

(0.000)

moratTRUE:after -0.010 ***

(0.001)

------------------------------------------------------------------

R^2 0.005 0.006 0.005

Adj. R^2 0.005 0.006 0.005

Num. obs. 1238009 1238009 4952036

==================================================================

*** p < 0.001; ** p < 0.01; * p < 0.059 Tasas

Acá si podemos tener antes y después porque la variable dependiente es la tasa de créditos nuevos otorgados.

Muestra: créditos nuevos otorgados entre marzo 2021 y junio 2022 a gente que haya estado activa y sin mora en diciembre 2021. Se marcan los que tenían mora previa (morat=1)

After: después de la ley

===============================================================================================

Model 1 Model 2 Model 3 Model 4 Model 5

-----------------------------------------------------------------------------------------------

(Intercept) 19.65 *** 19.09 ***

(0.03) (0.03)

afterTRUE -0.92 *** -0.92 *** -1.06 **

(0.04) (0.04) (0.17)

moratTRUE -1.80 *** -1.01 *** -0.43 -0.99 * -0.41

(0.03) (0.03) (0.18) (0.27) (0.19)

afterTRUE:moratTRUE 0.53 *** 0.54 *** 0.18 0.53 ** 0.36 **

(0.04) (0.04) (0.09) (0.07) (0.04)

debt -0.03 *** -0.02 -0.03 * 0.00 *

(0.00) (0.01) (0.01) (0.00)

rel_banks 0.59 *** 0.33 * 0.58 0.10

(0.01) (0.09) (0.25) (0.21)

tot_mora 0.00 *** 0.00 0.00 -0.00

(0.00) (0.00) (0.00) (0.00)

saldo -0.09 **

(0.01)

PLAZO_MESES_DEL_CREDITO -0.02

(0.02)

-----------------------------------------------------------------------------------------------

R^2 0.01 0.05

Adj. R^2 0.01 0.05

Num. obs. 667434 493661 493661 493661 493661

R^2 (full model) 0.26 0.05 0.17

R^2 (proj model) 0.04 0.05 0.17

Adj. R^2 (full model) 0.26 0.05 0.17

Adj. R^2 (proj model) 0.04 0.05 0.17

Num. groups: bank 40

Num. groups: date_info 4 4

===============================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.0510 Tasa con el mismo banco

==================================================================================================================

Model 1 Model 2 Model 3 Model 4 Model 5 Model 6

------------------------------------------------------------------------------------------------------------------

(Intercept) 16.74 *** 18.62 *** 20.42 *** 20.39 ***

(0.03) (0.03) (0.04) (0.04)

samebank 0.23 *** 0.08 -0.06 -0.07 -0.71 *** -0.07

(0.05) (0.05) (0.05) (0.05) (0.04) (0.58)

saldo -0.08 *** -0.06 *** -0.06 *** -0.05 *** -0.06 ***

(0.00) (0.00) (0.00) (0.00) (0.01)

PLAZO_MESES_DEL_CREDITO -0.04 *** -0.04 *** -0.03 *** -0.04

(0.00) (0.00) (0.00) (0.02)

PROBABILIDAD_DE_INCUMPLIMIENTO 0.01 *** -0.00 0.01

(0.00) (0.00) (0.01)

------------------------------------------------------------------------------------------------------------------

R^2 0.00 0.20 0.27 0.27

Adj. R^2 0.00 0.20 0.27 0.27

Num. obs. 57184 57184 57184 57184 57184 57184

R^2 (full model) 0.46 0.27

R^2 (proj model) 0.18 0.27

Adj. R^2 (full model) 0.46 0.27

Adj. R^2 (proj model) 0.18 0.27

Num. groups: bank 37

Num. groups: date_info 2

==================================================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.0511 Tasas si mora fue con mismo banco

- same_mora_new: 1 si banco de la mora es el mismo banco del crédito nuevo

- same_dec_new: 1 si banco con el que está activo en diciembre el mismo banco del crédito nuevo

- same_mora_new * same_dec_new: crédito nuevo es con el mismo banco con que estaba activo en diciembre y con el que tenía mora.

=======================================================================================================================================

Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 Model 7

---------------------------------------------------------------------------------------------------------------------------------------

(Intercept) 16.18 *** 19.93 *** 19.88 ***

(0.02) (0.03) (0.03)

same_mora_new -0.32 *** -0.26 *** -0.27 *** -0.25 *** -0.25 *** -0.27 *** -0.27

(0.07) (0.06) (0.06) (0.05) (0.05) (0.06) (0.48)

same_dec_new 0.02 -0.23 *** -0.24 *** -0.81 *** -0.81 *** -0.24 *** -0.24

(0.05) (0.05) (0.05) (0.04) (0.05) (0.05) (0.56)

same_mora_new:same_dec_new 1.04 *** 0.68 *** 0.69 *** 0.50 *** 0.50 *** 0.69 *** 0.69

(0.10) (0.08) (0.08) (0.07) (0.01) (0.08) (0.51)

saldo -0.06 *** -0.06 *** -0.04 *** -0.04 *** -0.06 *** -0.06 ***

(0.00) (0.00) (0.00) (0.01) (0.00) (0.01)

PLAZO_MESES_DEL_CREDITO -0.04 *** -0.04 *** -0.03 *** -0.03 * -0.04 *** -0.04

(0.00) (0.00) (0.00) (0.01) (0.00) (0.02)

PROBABILIDAD_DE_INCUMPLIMIENTO 0.02 *** 0.00 0.00 0.02 *** 0.02

(0.00) (0.00) (0.00) (0.00) (0.01)

---------------------------------------------------------------------------------------------------------------------------------------

R^2 0.00 0.28 0.28

Adj. R^2 0.00 0.28 0.28

Num. obs. 109904 109904 109904 109904 109904 109904 109904

R^2 (full model) 0.47 0.47 0.28 0.28

R^2 (proj model) 0.19 0.19 0.28 0.28

Adj. R^2 (full model) 0.47 0.47 0.28 0.28

Adj. R^2 (proj model) 0.19 0.19 0.28 0.28

Num. groups: bank 37 37

Num. groups: date_info 2 2

=======================================================================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.0512 Tasas si mora fue con mismo banco II

=======================================================================================================================================

Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 Model 7

---------------------------------------------------------------------------------------------------------------------------------------

(Intercept) 16.18 *** 19.93 *** 19.88 ***

(0.02) (0.03) (0.03)

same_mora_new -0.32 *** -0.26 *** -0.27 *** -0.25 *** -0.25 *** -0.27 *** -0.27

(0.07) (0.06) (0.06) (0.05) (0.05) (0.06) (0.48)

same_dec_new 0.02 -0.23 *** -0.24 *** -0.81 *** -0.81 *** -0.24 *** -0.24

(0.05) (0.05) (0.05) (0.04) (0.05) (0.05) (0.56)

same_mora_new:same_dec_new 1.04 *** 0.68 *** 0.69 *** 0.50 *** 0.50 *** 0.69 *** 0.69

(0.10) (0.08) (0.08) (0.07) (0.01) (0.08) (0.51)

saldo -0.06 *** -0.06 *** -0.04 *** -0.04 *** -0.06 *** -0.06 ***

(0.00) (0.00) (0.00) (0.01) (0.00) (0.01)

PLAZO_MESES_DEL_CREDITO -0.04 *** -0.04 *** -0.03 *** -0.03 * -0.04 *** -0.04

(0.00) (0.00) (0.00) (0.01) (0.00) (0.02)

PROBABILIDAD_DE_INCUMPLIMIENTO 0.02 *** 0.00 0.00 0.02 *** 0.02

(0.00) (0.00) (0.00) (0.00) (0.01)

---------------------------------------------------------------------------------------------------------------------------------------

R^2 0.00 0.28 0.28

Adj. R^2 0.00 0.28 0.28

Num. obs. 109904 109904 109904 109904 109904 109904 109904

R^2 (full model) 0.47 0.47 0.28 0.28

R^2 (proj model) 0.19 0.19 0.28 0.28

Adj. R^2 (full model) 0.47 0.47 0.28 0.28

Adj. R^2 (proj model) 0.19 0.19 0.28 0.28

Num. groups: bank 37 37

Num. groups: date_info 2 2

=======================================================================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.05

================================================================================================================================

Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 Model 7

--------------------------------------------------------------------------------------------------------------------------------

(Intercept) 16.18 *** 19.51 *** 19.45 ***

(0.02) (0.03) (0.03)

same_mora_new -0.32 *** -0.25 *** -0.26 *** -0.21 *** -0.21 *** -0.26 *** -0.26

(0.07) (0.06) (0.06) (0.05) (0.04) (0.06) (0.49)

saldo -0.06 *** -0.06 *** -0.04 *** -0.04 *** -0.06 *** -0.06 ***

(0.00) (0.00) (0.00) (0.01) (0.00) (0.01)

PLAZO_MESES_DEL_CREDITO -0.03 *** -0.03 *** -0.02 *** -0.02 -0.03 *** -0.03

(0.00) (0.00) (0.00) (0.01) (0.00) (0.02)

PROBABILIDAD_DE_INCUMPLIMIENTO 0.02 *** 0.01 ** 0.01 0.02 *** 0.02

(0.00) (0.00) (0.01) (0.00) (0.01)

--------------------------------------------------------------------------------------------------------------------------------

R^2 0.00 0.26 0.26

Adj. R^2 0.00 0.26 0.26

Num. obs. 75465 75465 75465 75465 75465 75465 75465

R^2 (full model) 0.46 0.46 0.26 0.26

R^2 (proj model) 0.17 0.17 0.26 0.26

Adj. R^2 (full model) 0.46 0.46 0.26 0.26

Adj. R^2 (proj model) 0.17 0.17 0.26 0.26

Num. groups: bank 37 37

Num. groups: date_info 2 2

================================================================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.0513 Montos

=============================================================================================

Model 1 Model 2 Model 3 Model 4 Model 5

---------------------------------------------------------------------------------------------

(Intercept) 10.32 *** 13.66 ***

(0.13) (0.10)

afterTRUE 1.30 *** 0.89 *** 1.34 *

(0.18) (0.12) (0.35)

moratTRUE 12.79 *** 4.61 *** 3.14 * 4.59 * 3.42

(0.15) (0.11) (0.75) (1.33) (1.08)

afterTRUE:moratTRUE -2.51 *** -1.56 *** -0.89 -1.55 ** -0.97 *

(0.20) (0.14) (0.39) (0.26) (0.24)

debt 0.32 *** 0.30 * 0.32 * 0.29 *

(0.00) (0.06) (0.06) (0.05)

rel_banks -5.03 *** -3.93 * -5.02 * -4.39 *

(0.03) (0.74) (0.88) (0.84)

tot_mora -0.01 *** -0.01 * -0.01 * -0.01 *

(0.00) (0.00) (0.00) (0.00)

rate -1.17 **

(0.14)

---------------------------------------------------------------------------------------------

R^2 0.02 0.40

Adj. R^2 0.02 0.40

Num. obs. 676674 500038 500038 500038 493661

R^2 (full model) 0.44 0.40 0.47

R^2 (proj model) 0.38 0.40 0.47

Adj. R^2 (full model) 0.44 0.40 0.47

Adj. R^2 (proj model) 0.38 0.40 0.47

Num. groups: bank 40

Num. groups: date_info 4 4

=============================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.0514 Plazos

==========================================================================================

Model 1 Model 2 Model 3 Model 4 Model 5

------------------------------------------------------------------------------------------

(Intercept) 54.40 *** 55.28 ***

(0.15) (0.16)

afterTRUE 0.30 0.21 -0.24

(0.20) (0.19) (1.10)

moratTRUE 11.71 *** 8.03 *** 3.35 7.99 6.10 *

(0.17) (0.17) (1.53) (2.73) (1.79)

afterTRUE:moratTRUE -1.05 *** -0.83 *** -0.31 -0.80 * -0.12

(0.22) (0.23) (0.16) (0.24) (0.27)

debt 0.08 *** 0.05 0.08 -0.04 *

(0.00) (0.02) (0.03) (0.01)

rel_banks -1.26 *** -0.35 -1.26 0.71

(0.05) (0.85) (1.97) (1.40)

tot_mora -0.00 *** 0.00 -0.00 0.00

(0.00) (0.01) (0.01) (0.01)

rate -0.63

(0.56)

saldo 0.33 *

(0.06)

------------------------------------------------------------------------------------------

R^2 0.01 0.03

Adj. R^2 0.01 0.03

Num. obs. 676674 500038 500038 500038 493661

R^2 (full model) 0.22 0.03 0.10

R^2 (proj model) 0.01 0.03 0.10

Adj. R^2 (full model) 0.22 0.03 0.10

Adj. R^2 (proj model) 0.01 0.03 0.10

Num. groups: bank 40

Num. groups: date_info 4 4

==========================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.0515 Perdida dado incumplimiento

===============================================================================

Model 1 Model 2 Model 3 Model 4

-------------------------------------------------------------------------------

(Intercept) 71.15 *** 68.78 ***

(0.05) (0.05)

afterTRUE 0.53 *** 0.33 *** 0.16

(0.06) (0.06) (0.45)

moratTRUE -2.37 *** -1.71 *** -0.08 -1.66

(0.05) (0.05) (0.28) (1.01)

afterTRUE:moratTRUE 1.07 *** 1.24 *** 0.58 * 1.19 **

(0.07) (0.07) (0.14) (0.12)

debt -0.03 *** -0.02 * -0.03

(0.00) (0.01) (0.01)

rel_banks 1.68 *** 0.76 1.67

(0.02) (0.25) (0.75)

tot_mora 0.01 *** 0.01 * 0.01

(0.00) (0.00) (0.00)

-------------------------------------------------------------------------------

R^2 0.01 0.04

Adj. R^2 0.01 0.04

Num. obs. 676638 500010 500010 500010

R^2 (full model) 0.41 0.04

R^2 (proj model) 0.02 0.03

Adj. R^2 (full model) 0.41 0.04

Adj. R^2 (proj model) 0.02 0.03

Num. groups: bank 40

Num. groups: date_info 4

===============================================================================

*** p < 0.001; ** p < 0.01; * p < 0.0516 Probabilidad de incumplimiento

==============================================================================

Model 1 Model 2 Model 3 Model 4

------------------------------------------------------------------------------

(Intercept) 2.36 *** 3.18 ***

(0.06) (0.07)

afterTRUE -0.04 0.06 0.07

(0.07) (0.08) (0.53)

moratTRUE 3.09 *** 3.54 *** 3.78 * 3.51 *

(0.06) (0.07) (0.90) (0.88)

afterTRUE:moratTRUE -0.29 *** -0.39 *** -0.41 -0.36

(0.08) (0.09) (0.50) (0.21)

debt -0.00 *** -0.00 -0.00

(0.00) (0.00) (0.00)

rel_banks -0.51 *** -0.35 -0.51

(0.02) (0.30) (0.41)

tot_mora 0.05 *** 0.05 * 0.05 *

(0.00) (0.01) (0.01)

------------------------------------------------------------------------------

R^2 0.01 0.05

Adj. R^2 0.01 0.05

Num. obs. 676674 500038 500038 500038

R^2 (full model) 0.07 0.05

R^2 (proj model) 0.05 0.05

Adj. R^2 (full model) 0.07 0.05

Adj. R^2 (proj model) 0.05 0.05

Num. groups: bank 40

Num. groups: date_info 4

==============================================================================

*** p < 0.001; ** p < 0.01; * p < 0.0517 Probabilidad garantía

==============================================================================

Model 1 Model 2 Model 3 Model 4

------------------------------------------------------------------------------

(Intercept) 0.04 *** 0.03 ***

(0.00) (0.00)

afterTRUE -0.01 *** -0.01 *** -0.01

(0.00) (0.00) (0.00)

moratTRUE 0.01 *** -0.00 *** 0.00 -0.00

(0.00) (0.00) (0.00) (0.01)

afterTRUE:moratTRUE -0.00 -0.01 *** -0.01 * -0.00

(0.00) (0.00) (0.00) (0.00)

debt 0.00 *** 0.00 * 0.00 *

(0.00) (0.00) (0.00)

rel_banks 0.00 * 0.00 0.00

(0.00) (0.00) (0.00)

tot_mora -0.00 -0.00 -0.00

(0.00) (0.00) (0.00)

------------------------------------------------------------------------------

R^2 0.00 0.01

Adj. R^2 0.00 0.01

Num. obs. 676674 500038 500038 500038

R^2 (full model) 0.35 0.01

R^2 (proj model) 0.01 0.01

Adj. R^2 (full model) 0.35 0.01

Adj. R^2 (proj model) 0.01 0.01

Num. groups: bank 40

Num. groups: date_info 4

==============================================================================

*** p < 0.001; ** p < 0.01; * p < 0.05