LBCN cartera consumo (Otros consumo) - Rates

1 Timeline

2 Rates of new loans

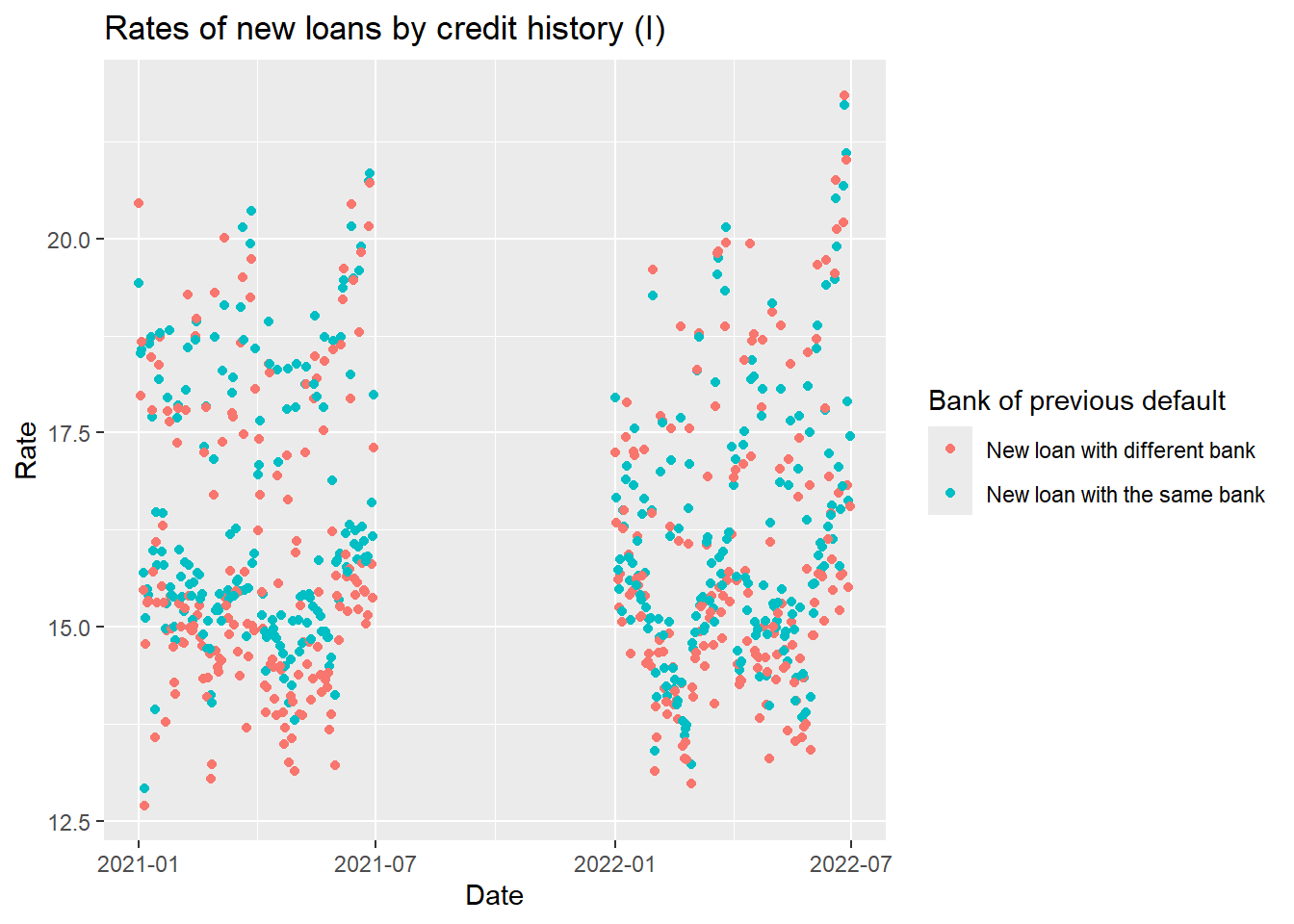

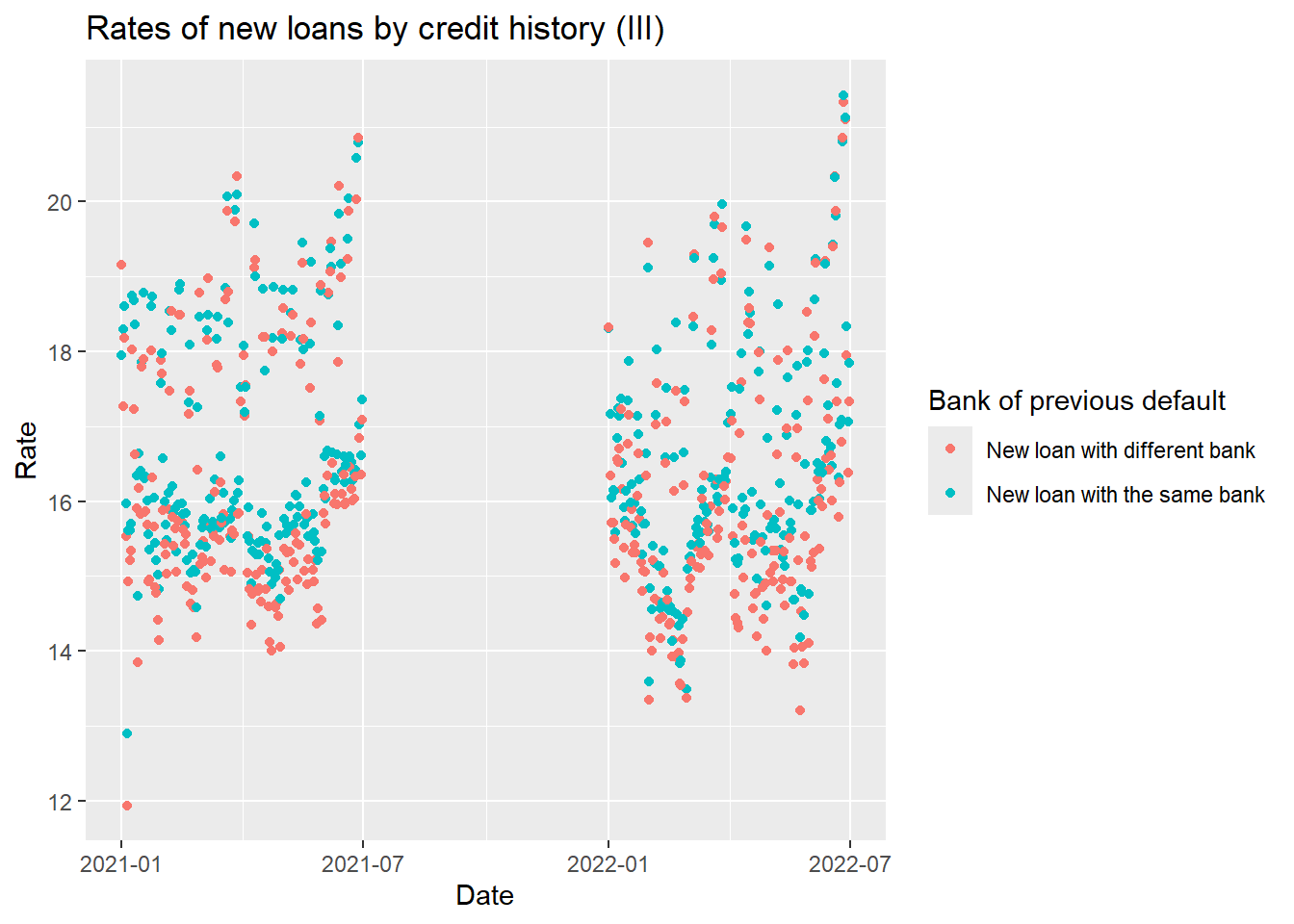

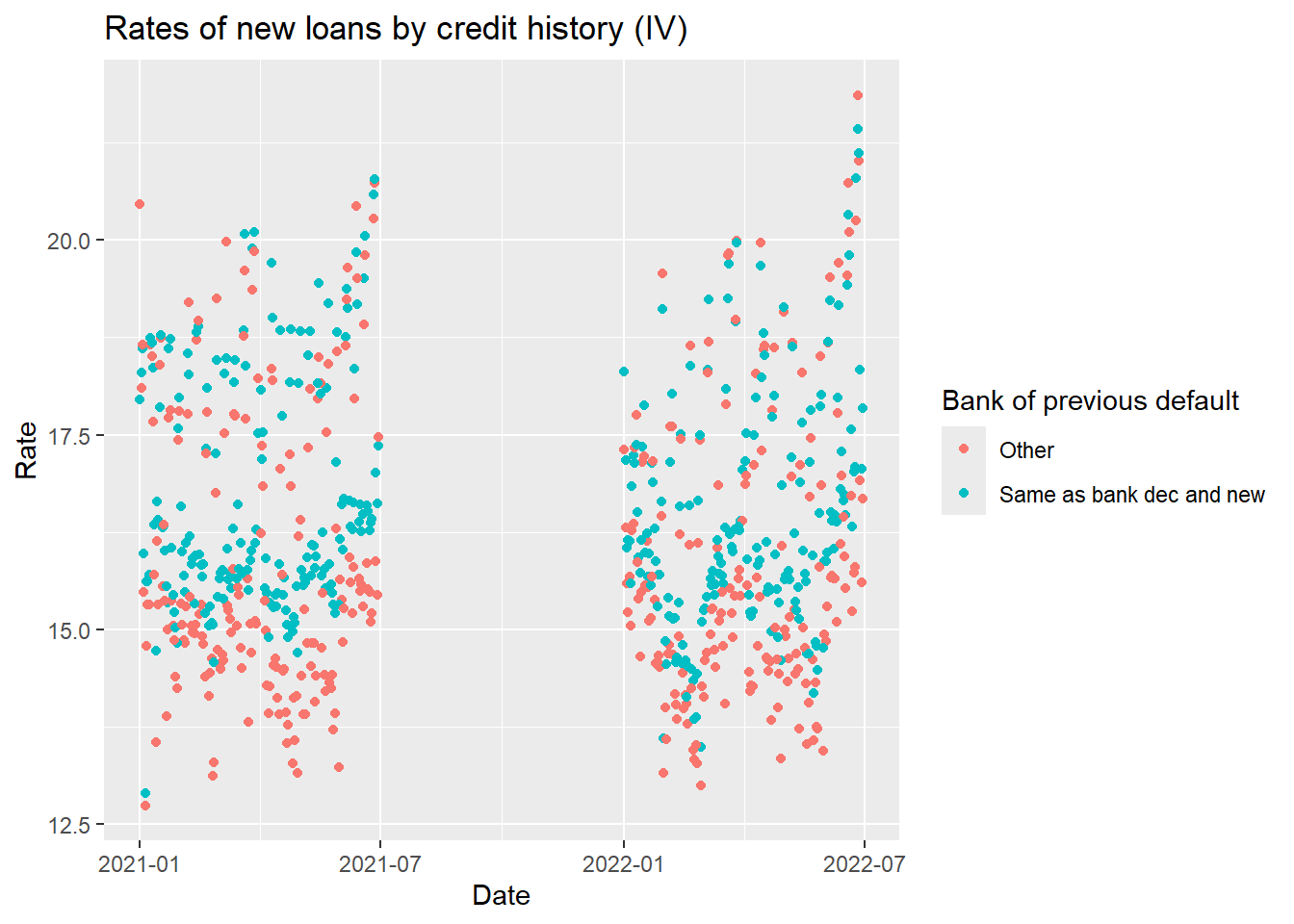

Sample: we start by keeping borrowers that were active (had some outstanding loan) in December 2020 and that had no defaults at the time. Our sample consists of new loans granted to these borrowers between March 2021 and June 2022 (two quarter before and two quarters after the law was enacted).

Dependendent variable: Rate of new loans minus the policy rate.

Covariates:

- Bank def. = Bank new is a dummy for whether the bank with which the person was defaulting is the same bank that grants the new loan.

- Bank act. = Bank new is a dummy for whether the bank with which the person was active in December 2020 is the same bank that grants the new loan.

- After is a dummy for quarters after the law is enacted.

- Amount of the loan in millions of pesos

- Maturity of the loan in months

- Prob. of default is the probability of deafult ex-ante calculated by the bank issuing the loan.

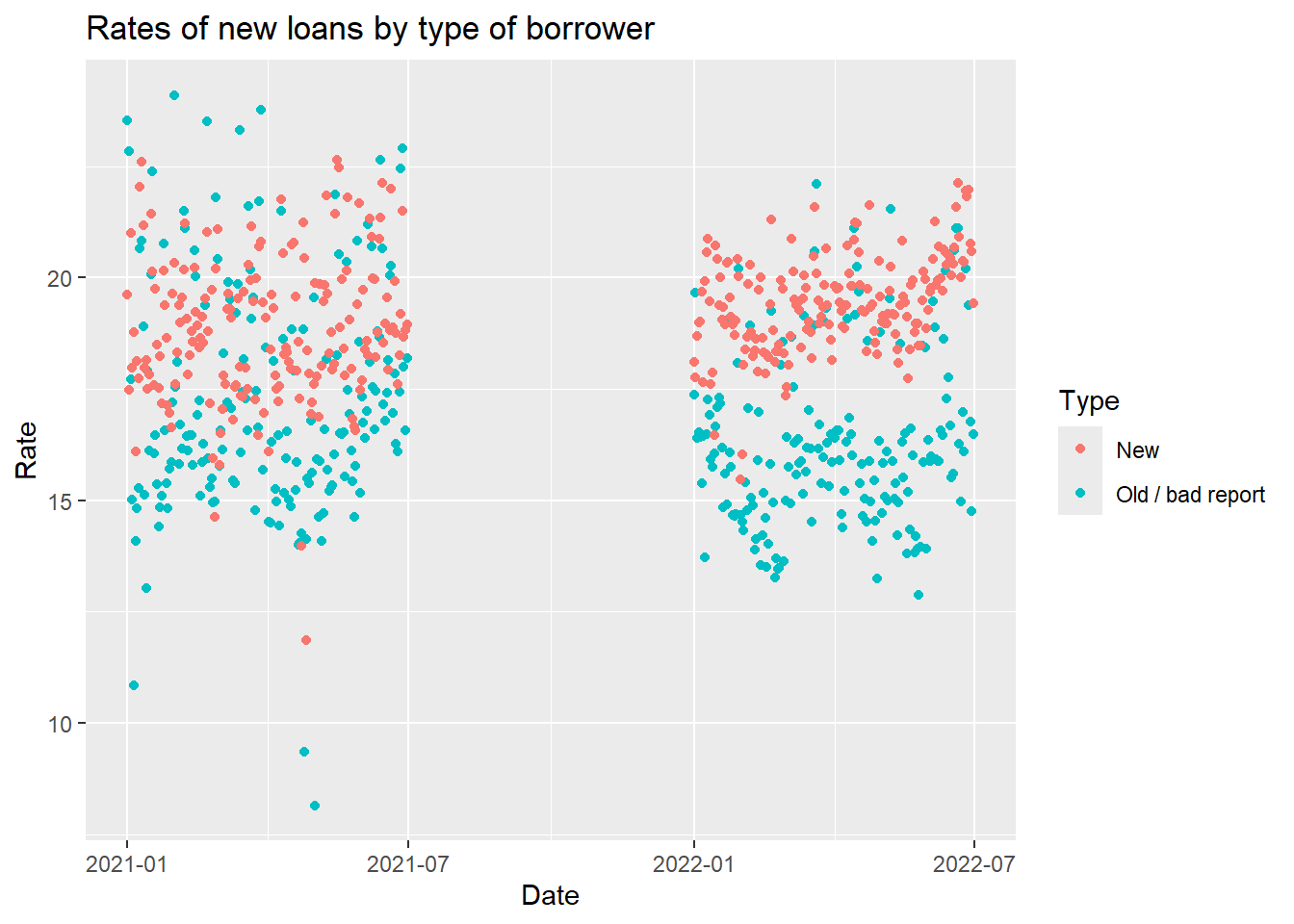

Rates of new loans before and after the blank slate law, as a function of whether the borrower had an old bad credit report.

We remove from the sample borrowers whose bank in Dec 2020 is the same bank issuing the new loan.

2.1 All borrowers

==============================================================================================================

Model 1 Model 2 Model 3 Model 4 Model 5

--------------------------------------------------------------------------------------------------------------

(Intercept) 18.97 ***

(0.01)

same_mora_new 0.17 *** 0.01 0.17 *** 0.01 0.01

(0.01) (0.01) (0.01) (0.01) (0.11)

after -0.28 *** -0.48 ***

(0.01) (0.01)

saldo -0.04 *** -0.03 *** -0.04 *** -0.03 *** -0.03 ***

(0.00) (0.00) (0.00) (0.00) (0.01)

PLAZO_MESES_DEL_CREDITO -0.04 *** -0.03 *** -0.04 *** -0.03 *** -0.03 *

(0.00) (0.00) (0.00) (0.00) (0.01)

PROBABILIDAD_DE_INCUMPLIMIENTO 0.02 *** 0.01 *** 0.02 *** 0.01 *** 0.01 **

(0.00) (0.00) (0.00) (0.00) (0.00)

same_mora_new:after -0.06 *** -0.05 *** -0.05 *** -0.05 *** -0.05

(0.01) (0.01) (0.01) (0.01) (0.13)

--------------------------------------------------------------------------------------------------------------

R^2 0.27

Adj. R^2 0.27

Num. obs. 4002642 4002642 4002642 4002642 4002642

R^2 (full model) 0.42 0.27 0.42 0.42

R^2 (proj model) 0.18 0.27 0.18 0.18

Adj. R^2 (full model) 0.42 0.27 0.42 0.42

Adj. R^2 (proj model) 0.18 0.27 0.18 0.18

Num. groups: bank 38 38 38

Num. groups: date_info 4 4 4

==============================================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.052.2 Keeping only borrowers not seen by the bank

Here we keep only borrowers that were banking in December 2020 with a different bank than the bank issuing the new loan (same_dec_new==0)

==============================================================================================================

Model 1 Model 2 Model 3 Model 4 Model 5

--------------------------------------------------------------------------------------------------------------

(Intercept) 18.75 ***

(0.01)

same_mora_new 0.15 *** 0.03 *** 0.15 *** 0.03 ** 0.03

(0.01) (0.01) (0.01) (0.01) (0.08)

after -0.25 *** -0.45 ***

(0.01) (0.01)

saldo -0.04 *** -0.03 *** -0.04 *** -0.03 *** -0.03 ***

(0.00) (0.00) (0.00) (0.00) (0.01)

PLAZO_MESES_DEL_CREDITO -0.03 *** -0.03 *** -0.03 *** -0.03 *** -0.03 *

(0.00) (0.00) (0.00) (0.00) (0.01)

PROBABILIDAD_DE_INCUMPLIMIENTO 0.02 *** 0.01 *** 0.02 *** 0.01 *** 0.01 **

(0.00) (0.00) (0.00) (0.00) (0.00)

same_mora_new:after -0.12 *** -0.14 *** -0.12 *** -0.13 *** -0.13

(0.02) (0.01) (0.02) (0.01) (0.11)

--------------------------------------------------------------------------------------------------------------

R^2 0.28

Adj. R^2 0.28

Num. obs. 2983677 2983677 2983677 2983677 2983677

R^2 (full model) 0.43 0.28 0.43 0.43

R^2 (proj model) 0.18 0.28 0.18 0.18

Adj. R^2 (full model) 0.43 0.28 0.43 0.43

Adj. R^2 (proj model) 0.18 0.28 0.18 0.18

Num. groups: bank 38 38 38

Num. groups: date_info 4 4 4

==============================================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.052.3 Keeping only borrowers seen by the bank

Here we keep only borrowers that were banking in December 2020 with the same bank issuing the new loan (same_dec_new==1)

==============================================================================================================

Model 1 Model 2 Model 3 Model 4 Model 5

--------------------------------------------------------------------------------------------------------------

(Intercept) 20.09 ***

(0.01)

same_mora_new 0.15 *** 0.03 ** 0.15 *** 0.03 ** 0.03

(0.01) (0.01) (0.01) (0.01) (0.14)

after -0.45 *** -0.62 ***

(0.01) (0.01)

saldo -0.03 *** -0.03 *** -0.03 *** -0.03 *** -0.03 ***

(0.00) (0.00) (0.00) (0.00) (0.00)

PLAZO_MESES_DEL_CREDITO -0.06 *** -0.05 *** -0.06 *** -0.05 *** -0.05 ***

(0.00) (0.00) (0.00) (0.00) (0.01)

PROBABILIDAD_DE_INCUMPLIMIENTO 0.02 *** 0.02 *** 0.02 *** 0.02 *** 0.02

(0.00) (0.00) (0.00) (0.00) (0.01)

same_mora_new:after 0.12 *** 0.18 *** 0.12 *** 0.18 *** 0.18

(0.02) (0.02) (0.02) (0.02) (0.12)

--------------------------------------------------------------------------------------------------------------

R^2 0.28

Adj. R^2 0.28

Num. obs. 1018965 1018965 1018965 1018965 1018965

R^2 (full model) 0.40 0.28 0.40 0.40

R^2 (proj model) 0.20 0.28 0.20 0.20

Adj. R^2 (full model) 0.40 0.28 0.40 0.40

Adj. R^2 (proj model) 0.20 0.28 0.20 0.20

Num. groups: bank 28 28 28

Num. groups: date_info 4 4 4

==============================================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.052.4 Adding a dummy for when bank in Dec 2020 is the same bank issuing the new loan

Adding a dummy for when the bank with which the borrower defaulted, with which the borrower was active in December 2021 and the bank issuing the new loan are the same.

================================================================================================================

Model 1 Model 2 Model 3 Model 4 Model 5

----------------------------------------------------------------------------------------------------------------

(Intercept) 18.93 ***

(0.01)

same_mora_new 0.15 *** 0.03 *** 0.15 *** 0.03 ** 0.03

(0.01) (0.01) (0.01) (0.01) (0.08)

same_dec_new 0.16 *** -0.11 *** 0.16 *** -0.11 *** -0.11

(0.01) (0.01) (0.01) (0.01) (0.18)

after -0.24 *** -0.44 ***

(0.01) (0.01)

saldo -0.04 *** -0.03 *** -0.04 *** -0.03 *** -0.03 ***

(0.00) (0.00) (0.00) (0.00) (0.01)

PLAZO_MESES_DEL_CREDITO -0.04 *** -0.03 *** -0.04 *** -0.03 *** -0.03 *

(0.00) (0.00) (0.00) (0.00) (0.01)

PROBABILIDAD_DE_INCUMPLIMIENTO 0.02 *** 0.01 *** 0.02 *** 0.01 *** 0.01 **

(0.00) (0.00) (0.00) (0.00) (0.00)

same_mora_new:same_dec_new -0.03 -0.01 -0.02 -0.01 -0.01

(0.02) (0.02) (0.02) (0.02) (0.17)

same_mora_new:after -0.12 *** -0.14 *** -0.12 *** -0.13 *** -0.13

(0.02) (0.01) (0.02) (0.01) (0.11)

same_dec_new:after -0.16 *** -0.19 *** -0.15 *** -0.18 *** -0.18

(0.01) (0.01) (0.01) (0.01) (0.25)

same_mora_new:same_dec_new:after 0.22 *** 0.30 *** 0.22 *** 0.30 *** 0.30 *

(0.03) (0.02) (0.03) (0.02) (0.12)

----------------------------------------------------------------------------------------------------------------

R^2 0.27

Adj. R^2 0.27

Num. obs. 4002642 4002642 4002642 4002642 4002642

R^2 (full model) 0.42 0.27 0.42 0.42

R^2 (proj model) 0.18 0.27 0.18 0.18

Adj. R^2 (full model) 0.42 0.27 0.42 0.42

Adj. R^2 (proj model) 0.18 0.27 0.18 0.18

Num. groups: bank 38 38 38

Num. groups: date_info 4 4 4

================================================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.05We add more controls in Section 3.1.

2.5 Rates of new loans to new borrowers and old borrowers with previous bad reports

Here we plot the rates of new loans before and after the law for two types of borrowers. Borrowers that had never borrowed before (New) and active borrowers that had defaulted some time before December 2020 (Old/bad report).

Let A, B and C stand for the banks with which the borrower defaulted, was active in December 2020 and got a new loan respectively:

==========================================================================================================

Model 1 Model 2 Model 3 Model 4 Model 5

----------------------------------------------------------------------------------------------------------

Constant 19.81 *** 20.09 *** 20.13 *** 20.12 *** 20.07 ***

(0.03) (0.03) (0.03) (0.03) (0.03)

Old/bad report 0.30 ***

(0.05)

After 0.90 *** 0.48 *** 0.42 *** 0.42 *** 0.51 ***

(0.03) (0.03) (0.03) (0.03) (0.03)

Amount(mill. Pesos) -0.06 *** -0.06 *** -0.06 *** -0.06 *** -0.06 ***

(0.00) (0.00) (0.00) (0.00) (0.00)

Maturity(months) -0.02 *** -0.03 *** -0.03 *** -0.03 *** -0.03 ***

(0.00) (0.00) (0.00) (0.00) (0.00)

Prob. default 0.01 *** 0.01 *** 0.00 *** 0.00 0.00 ***

(0.00) (0.00) (0.00) (0.00) (0.00)

Old/bad report x After -1.96 ***

(0.06)

Old/bad report: B=C -0.01 -0.13

(0.07) (0.07)

(Old/bad report: B=C) x After -1.59 *** -1.65 ***

(0.09) (0.09)

Old/bad report: A=B 0.51 ***

(0.11)

(Old/bad report: A=B) x After -1.18 ***

(0.14)

Old/bad report: A=C 1.10 *** 0.83 ***

(0.12) (0.15)

(Old/bad report: A=C) x After -1.30 *** -1.32 ***

(0.16) (0.20)

Old/bad report: A=B=C 0.69 **

(0.25)

(Old/bad report: A=B=C) x After 1.51 ***

(0.35)

----------------------------------------------------------------------------------------------------------

R^2 0.16 0.16 0.15 0.15 0.16

Adj. R^2 0.16 0.16 0.15 0.15 0.16

Num. obs. 242082 242082 242082 242082 242082

==========================================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.053 Appendix

3.1 Rates of new loans

We add more controls

================================================================================

Model 1 Model 2 Model 3

--------------------------------------------------------------------------------

same_mora_new 0.12 0.12 0.10

(0.07) (0.07) (0.09)

same_dec_new 0.03 0.02 0.00

(0.17) (0.17) (0.13)

after

saldo -0.03 *** -0.04 *** -0.04 ***

(0.01) (0.01) (0.01)

rel_banks 0.18 ** 0.13 ** 0.14 **

(0.05) (0.04) (0.05)

relq -0.00 -0.00 -0.01

(0.01) (0.01) (0.01)

PLAZO_MESES_DEL_CREDITO -0.03 * -0.03 * -0.02 *

(0.01) (0.01) (0.01)

PROBABILIDAD_DE_INCUMPLIMIENTO 0.01 ** 0.01 ** 0.01

(0.00) (0.00) (0.00)

same_mora_new:same_dec_new 0.04 0.03 0.05

(0.13) (0.13) (0.11)

same_mora_new:after -0.13 -0.13 -0.17

(0.10) (0.10) (0.10)

same_dec_new:after -0.19 -0.18 -0.14

(0.25) (0.25) (0.13)

same_mora_new:same_dec_new:after 0.28 * 0.29 * 0.28 *

(0.12) (0.12) (0.11)

debt 0.00 ** 0.00 *

(0.00) (0.00)

tot_mora 0.00

(0.00)

--------------------------------------------------------------------------------

Num. obs. 4002642 4002642 2311979

R^2 (full model) 0.43 0.43 0.37

R^2 (proj model) 0.18 0.18 0.17

Adj. R^2 (full model) 0.43 0.43 0.37

Adj. R^2 (proj model) 0.18 0.18 0.17

Num. groups: bank 38 38 38

Num. groups: date_info 4 4 4

================================================================================

*** p < 0.001; ** p < 0.01; * p < 0.05