Chapter 5 The Scenarios for the Future of the Air Transport

In the beginning of this project, it has been explained the forecast for the aviation industry before the COVID-19 arrival. Following, it has been seen the impact on the aviation industry under a routes point of view. Finally, the last step consists in quantifying the economic impact and visualize, still inside the pandemic, the scenarios that are most likely to explain the future of the industry.

As of June 8, the latest estimations published by ICAO show that the COVID-19 impact would generate an overall reduction between 40% to 53% of the seats offered by airlines, with an overall reduction of 2.2 to 3 billion passengers for the full year 2020. This will cause a loss between 300 to 400 billion dollars. Of course, these estimations depend on the duration of the outbreak, the confidence of the costumers to travel again and the economic conditions.

As Dean Donovan (2020) details in the Editors' Pick of Forbes magazine, "Many nations have closed their borders to prevent the spread of the disease today and will probably continue to regard foreign travel with far more suspicion than domestic travel. Western governments also will find it harder to restrict domestic travel volumes than international volumes. For similar reasons, customer confidence in international flying will return more slowly than for domestic flights. Finally, bigger planes have higher trip costs and create more economic risk when demand is depressed. Expect volume to return slowest in international long-haul, especially segments that extra-long-range narrow bodies can’t handle".

It is not surprising that the forecasts for international traffic are more pessimistic than domestic traffic.

| Passenger Traffic | Drop in seats offered by airlines | Reduction in billion passengers | Operation revenues loss in billion dolars |

|---|---|---|---|

| International | 48% - 63% | 1.105 - 1.440 | 195 to 250 |

| Domestic | 33% - 45% | 1.190 - 1.630 | 110 to 145 |

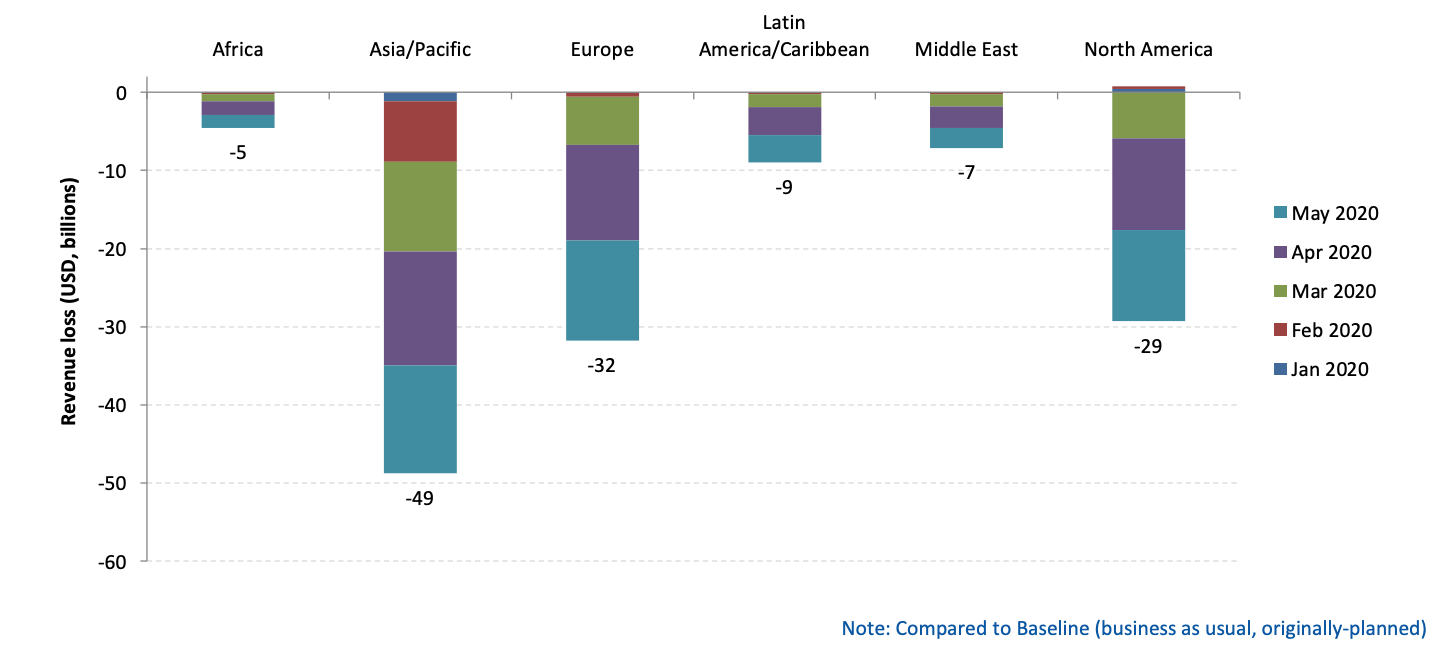

From January to May, approximately there has been lost around 130 billion USD dollars in passenger revenue. As ICAO estimates, the most affected regions have been: Asia/Pacific, Europe and North America respectively.

Figure 5.1: Passenger Revenue Loss per region. Source: ICAO

It was clear from the very beginning COVID-19 would mark a milestone. In fact, the impact of COVID-19, as of June 8, has surpassed by far that generated by SARS-2003, which resulted in a reduction of 6 billion dollars in revenues for Asia/Pacific airlines. As ICAO states, is day by day more clear that "the 6 month recovery path of SARS-2003 might not apply to today's situation". There is no doubt though, there are a lot of uncertainties surrounding the current situation. How much more the pandemic and the lockdowns will last? How deep will the global recession be? These are just a couple of questions without answers that will highly influence the sector. However, and as was mentioned in the beginning of the project, the aviation industry is characterized for cyclicality. Air transport will recover, the unknown is in what shape. (Bureau 2020)

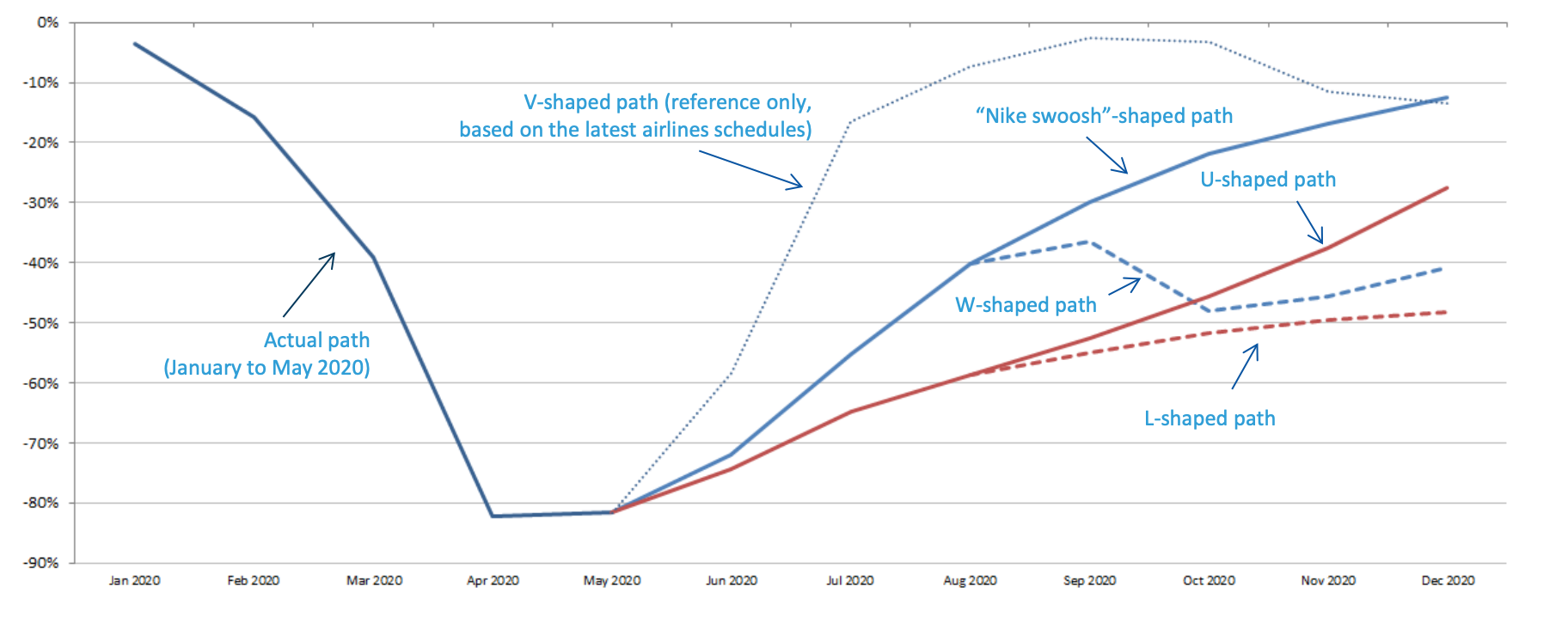

The informal classification to describe different types of recessions is:

V-shaped: The most common shape for a recession. The economy suffers a clearly defined sharp and brief period of decline followed by a quick recovery.

U-shaped: This type of recession is less-clear that V-shape recession and longer. It has a more prolonger contraction and a smoother recovery.

W-shaped: Also known as double-dip, it represents a fall into recession, followed by a short period of recovery, then falls back into recession before finally recovering.

L-shaped: This shape occurs when an economy has a deep recession and does not return to the previous trend line for many years.

“Nike swoosh”-shaped or Tick Shape: Similar to the V-shaped but with a more gradual, but still aggressive recovery.

This can be applied to the seat capacity supply:

Figure 5.2: Scenarios for passenger seat capacity. Source: ICAO

In the first stages of the outbreak, there was the economic consensus the recession would be V-shaped. In fact, the reason why airlines did not lay off in mass their pilots, mechanics or suppliers is because it was expected there would be a need for them shortly after the pandemic subsides. Governments have spent billions of dollars to maintain their airlines afloat, allowing them to apply temporary lays off until the repressed demand raised again. However, this has resulted to be a utopia.

What in the beginning was predicted to be a V is now expected to be more like a U, L or "Nike Swoosh". The recent corporate announcements in late April/early March are fading the V-shape scenario. The low cost, Norwegian on April 27 warned that virtually most of its fleet of aircraft will be grounded until 2021 (Topham 2020). Meanwhile, British Airways announced on April 28 its plans to lay off 12 K employees and announced it would take several years to return to last year's passenger levels (Neate 2020). Also, Ryanair announced on May 1, 3 K jobs cut as COVID-19 continued to batter the travel industry (Braithwaite 2020). An like these, several airlines around the world.

As director-general of IATA, Alexandre de Junaic, said: “The industry’s outlook grows darker by the day. The scale of the crisis makes a sharp V-shaped recovery unlikely. Realistically, it will be a U-shaped recovery with domestic travel coming back faster than the international market" (SIDHU 2020). Others, like Delta Air Line CEO Ed Bestian thinks the recovery in air demand will probably be shaped more like the Nike "Swoosh" logo. Even though, all of them agree that there will be necessary between 3 to 5 years to reach the pre-COVID expectations.

The outbreak has forced almost everyone to readapt, working by remote meeting is now an extended practice. This will highly affect business travel, which will be limited to meet essential needs.

Leisure passengers, as their confidence and economic wealth increase, are expected to be very cautious in booking new flights. As IdeaWorksCompany.com cites in its report: Costumers spending will be fragile and will expect low prices. They will assess the overall cost of a trip to include the ticket price, plus all fees, and the hotel rate" (Sorensen 2020).

Airlines will have an essential role in stimulating people to travel. However, as Wizz Air CEO, József Váradi, states "The problem, by and large, is not people’s intention to travel, but rather the restrictions put in place by governments, which makes things quite unpredictable. During good times, with no state restrictions, we operate in 45 countries. There are currently no two countries of those 45 that have imposed the same restrictions. The whole process has become totally uncoordinated, it's quite a mess and it makes it very hard for people to look past these issues, of how they can leave their country, how they can get into another country, and how their movements will be restricted."

It will not be only required the effort of the airlines but, the coordination of the countries to help and encourage people to head to the boarding gates.